When it comes to achieving that enviable glow, Bella Body & Skin Studio has the magic touch. From rejuvenating facials to luxurious body treatments, this local gem is all about helping you shine — inside and out.

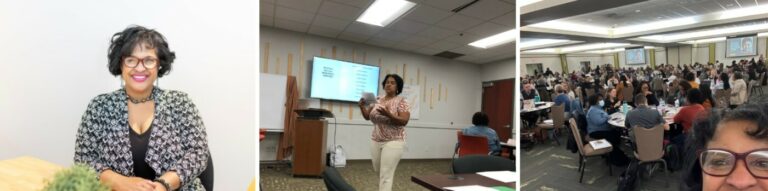

Founded by Dr. Carla Jenkins, Bella Body & Skin Studio was founded with the mission to “help not only women, but everyone, feel beautiful in their own healthy skin and bodies and to increase sense of wellness and well-being.”

Jenkins has 20 years of nursing experience in various areas of critical care and has always taken a personal interest in skin care and general health.

The experts at Bella Body & Skin Studio offer an array of services that include:

- Injectable services

- Facial skin services

- Cosmetic and body services

- IV nutrition therapy

- Hair services

- Weight loss and wellness programs

Bella Body & Skin Studio also sells medical grade skin care products like the Bella skin care bright eye serum and the Bella skin care complexion serum.

The studio is at 9595 Whitley Dr. Suite 200 and is open Tuesday through Friday from 10 a.m. to 6 p.m. and on Saturday from 10 a.m. to 4 p.m. The studio is closed on Sunday and Monday.

For more information, visit bellabodyskinstudio.com.

Two new retailers fill prime space at the Stutz – Indiana Minority Business Magazine

Contact Health & Environmental Reporter Hanna Rauworth at 317-762-7854 or follow her on Instagram at @hanna.rauworth. If you would like your business highlighted by the Indiana Minority Business Magazine, click here.