By EVAN HOFFMEYER

Indiana will soon have its first de novo bank in nearly 20 years, according to an American Bankers Association (ABA) analysis of FDIC data. Generations Community Bank (GCB) received regulatory approval from both state and federal agencies this summer, pending completion of the bank’s capital raise. Leaders hope to finish that in time to open their doors by the end of the year, by the first quarter of 2026 at the latest. De novo approvals have plummeted since the financial crisis of 2008-10, as seen in the chart below. However, there is an expectation among some analysts that we may finally start to see more de novo activity under the current regulatory environment.

Minority Depository Institution

Generations represents a second landmark for the state as it is also on track to be Indiana’s first Minority Depository Institution (MDI) bank. MDIs are an official classification by the Federal Deposit Insurance Corporation (FDIC) for federally insured depository institutions that either (1) have 51% or more of their voting stock owned by minority individuals or (2) have a board of directors that is majority minority and serves a community that is predominantly minority.

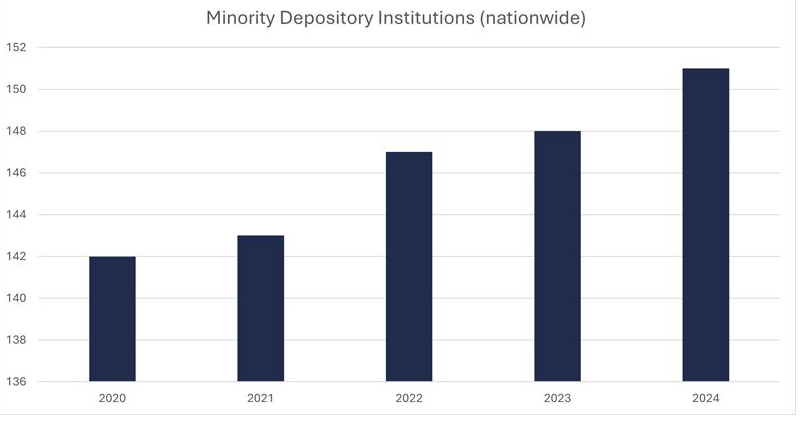

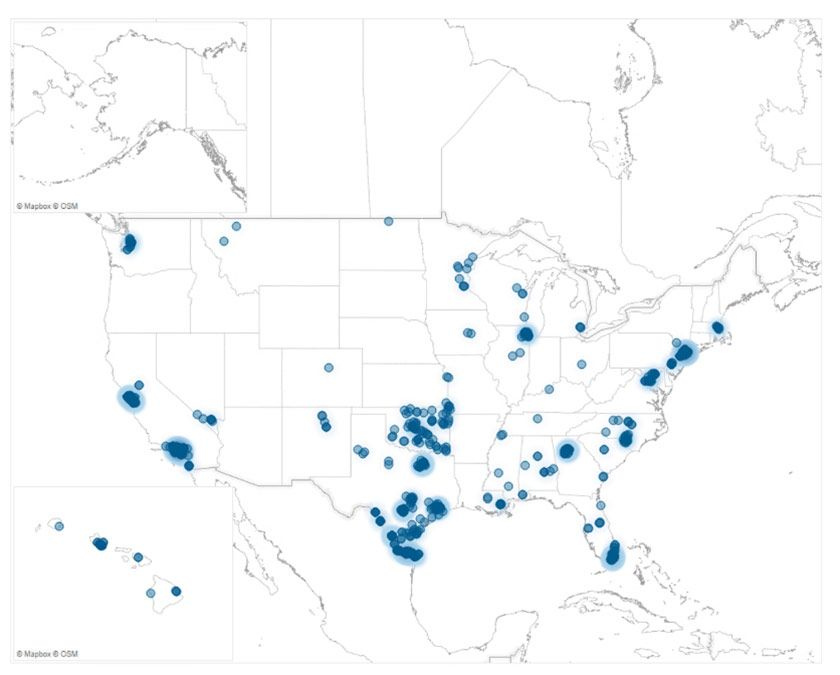

While there are not currently any MDI banks in Indiana, there were 152 across the country holding a combined $371 billion in assets as of March 31, 2025, including 10 in the FDIC’s Chicago region, which governs Indiana.

Longer-term trends among MDIs reflect the broader industry in terms of merger and acquisition activity and a lack of de novos, but since the pandemic, MDIs have been on a steady pace of growth from the number of institutions and branches to overall assets and deposits.

A recent report from the National Bankers Association (NBA) found that MDI assets grew 90% from 2014 to 2024, and 43% since the 2019/pre-pandemic era. MDIs are also expanding geographically, jumping from 32 states and territories in 2022-23 to 43 by year-end 2024.

Mission-driven institution

Generations’ primary source of initial funding came from Old National Bank (ONB), Evansville. Old National said that its primary regulator, the Office of the Comptroller of the Currency, approached CEO Jim Ryan several years ago and informally asked if his team could provide guidance to struggling MDIs.

He asked the bank’s CEO Council, a group of emerging leaders within the institution, to research the topic and come back with ideas. When they discovered Indiana didn’t have any, they recommended that instead of helping out-of-state organizations, ONB should help start a new one in Indiana.

“Along with its recommendation, the CEO Council created a high-level business plan for the MDI” that would become Generations Community Bank, according to Al London.

London currently serves as senior vice president, community impact director for ONB, but will become Generations’ CEO when it completes its initial capital raise.

“While ONB is proud to have several programs and initiatives in place to serve underserved populations, it recognizes that an even greater impact can be made by helping launch an MDI in our home state,” London said.

Mission-driven banks play a crucial role in the communities they serve. The NBA report found communities with an MDI present have better credit health as measured by factors like credit score, total credit available and credit utilization rates, relative to demographically similar communities that do not have an MDI present. An ABA analysis of Small Business Administration (SBA) lending data found MDIs originated roughly 2,500 SBA loans in 2024, totaling $2.2 billion – a 250% increase from pre-COVID figures in 2019.

Generations’ mission is to speak the language of its community and similarly fill the gaps in access to quality financial products and services through the bank’s core values of collaboration, communication, innovation and discipline.

“It is important to note that MDIs were created in the first place because the traditional banking system is generally not equipped to address these issues as effectively as mission-driven banks,” said Rafael Sanchez, Old National Bank’s executive vice president, chief impact officer and Indianapolis Market president. “Old National intends to partner with Generations Community Bank to help drive even more impact to Hoosiers in central Indiana.”

Personal mission

It was that dedication to the mission that led London to leave a successful, stable position with a national bank and take the leap to build something from scratch.

“I was at a point in my career where I had begun to ask myself, ‘What do I want my career legacy to be?’ and ‘How will I be able to identify how I made a difference in the community that I call home?’” he said. “The mission is part of the DNA of GCB versus being a department of the bank. My mother taught me and my siblings the importance/power of helping your fellow neighbor. The opportunity to lead Generations Community Bank allows me to honor that teaching while making an economic difference in Indiana.”

London and his team aim to address the wealth gap in central Indiana that, according to GCB’s research, currently shows white families holding on average 7.8 times the net wealth of a Black family and 30% more homeownership than Black individuals, 27% more than Latin Americans and 15% more than Asian Americans.

“Generations Community Bank’s service model aims to provide the resources, education and financial support to create more business owners and homeowners from underserved communities, and assist them in creating generational wealth,” he said.

“…This bank will serve the entire community … It will be a very inclusive, mission-driven bank…”

Al London

Despite the bank’s emphasis on underserved populations, London emphasized that “this bank will serve the entire community. It is not a Black bank or a Latino bank or an Asian bank. It will be a very inclusive, mission-driven bank that will aim to create economic mobility for all Hoosiers and will pay close attention to and focus on those communities that have been overlooked and underserved.”

“In this sense, the bank will be focused on equality of opportunity, not equality of results,” Sanchez added. “We are proud to have the support of Gov. Mike Braun and our state and federal regulators.”

“I want to express my heartfelt appreciation for Jim Ryan, Rafael Sanchez, Roland Shelton, the ONB family and the Generations Community Bank Board of Directors for their unwavering support,” London added. “We truly appreciate the support we have received from other Indiana community banks who made the decision to join us on this historic journey.”

De novo

The time from those initial discussions with Old National’s CEO Council to GCB’s anticipated opening will be roughly the 2.5 years it takes the average MDI to get off the ground. It was delayed by the change in presidential administration, but the Indiana Department of Financial Institutions approved the bank’s charter application on July 10, and the FDIC followed suit on Aug. 21. The final piece is to complete the bank’s initial capital raise.

While ONB provided the first significant round of funding and GCB’s top executives are currently on the bank’s payroll, it will not own GCB. London could not disclose the names of additional investors but said they do have many well-known community and business leaders in the bank’s ownership group, with the intention of Old National not holding more than 4.99% of Generations’ voting shares moving forward.

Without naming specific institutions, Sanchez confirmed several community banks have signed up as investors with more expressing an interest and running through their approval processes. Assuming it is approved for MDI status, investment can count toward a bank’s Community Reinvestment Act rating even if the community the MDI serves is not in the investing bank’s assessment area.

“We are excited that we have already obtained commitments from other local banks, as we think this is a great opportunity for many banks to collaborate and partner together for the betterment of our community,” London said.

This story was originally published by Hoosier Banker.

Evan Hoffmeyer is the vice president of Communications at the Indiana Bankers Association.